Berps Trades

The following are the different types of trades that a trader can make with Berps.

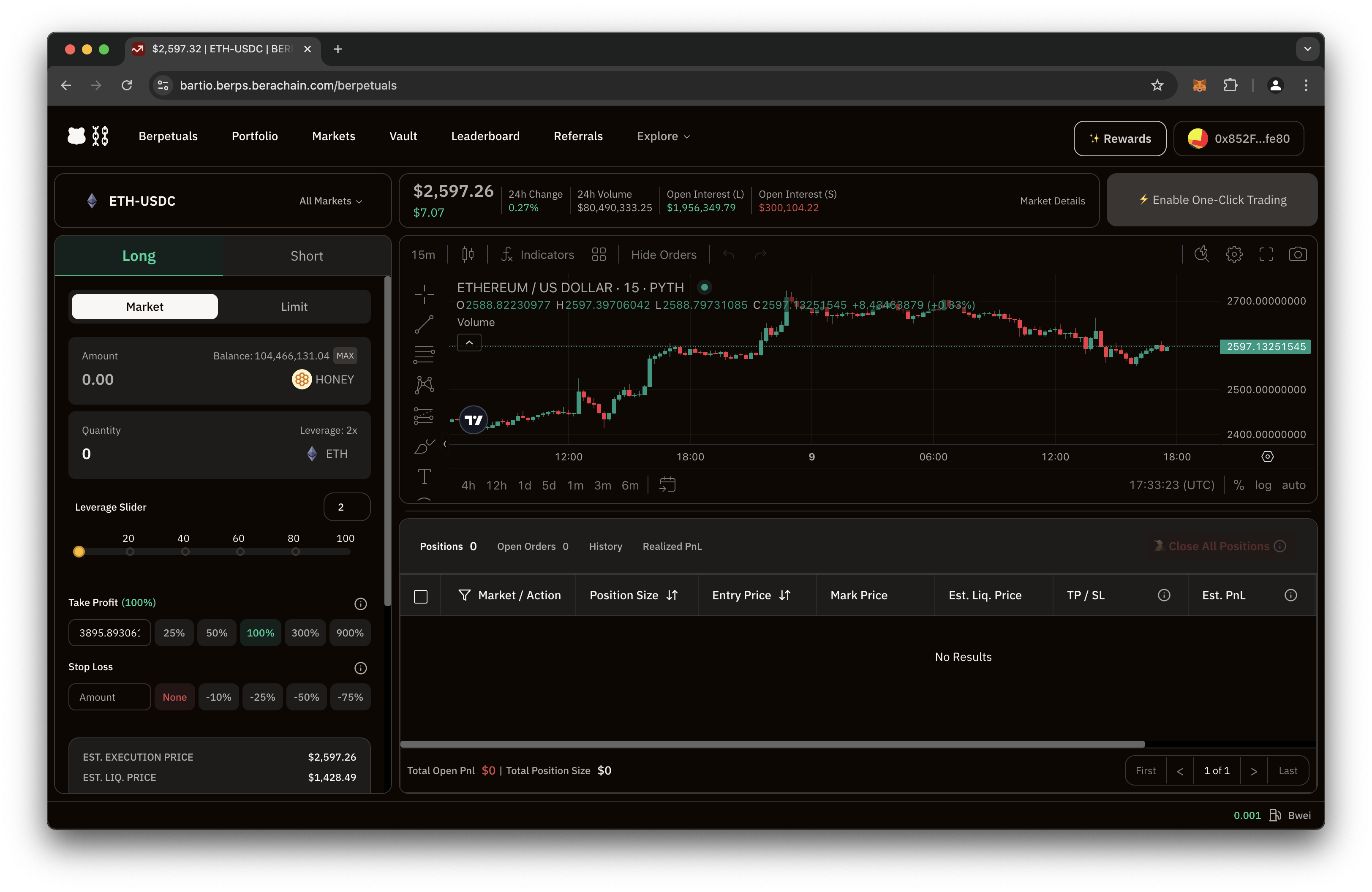

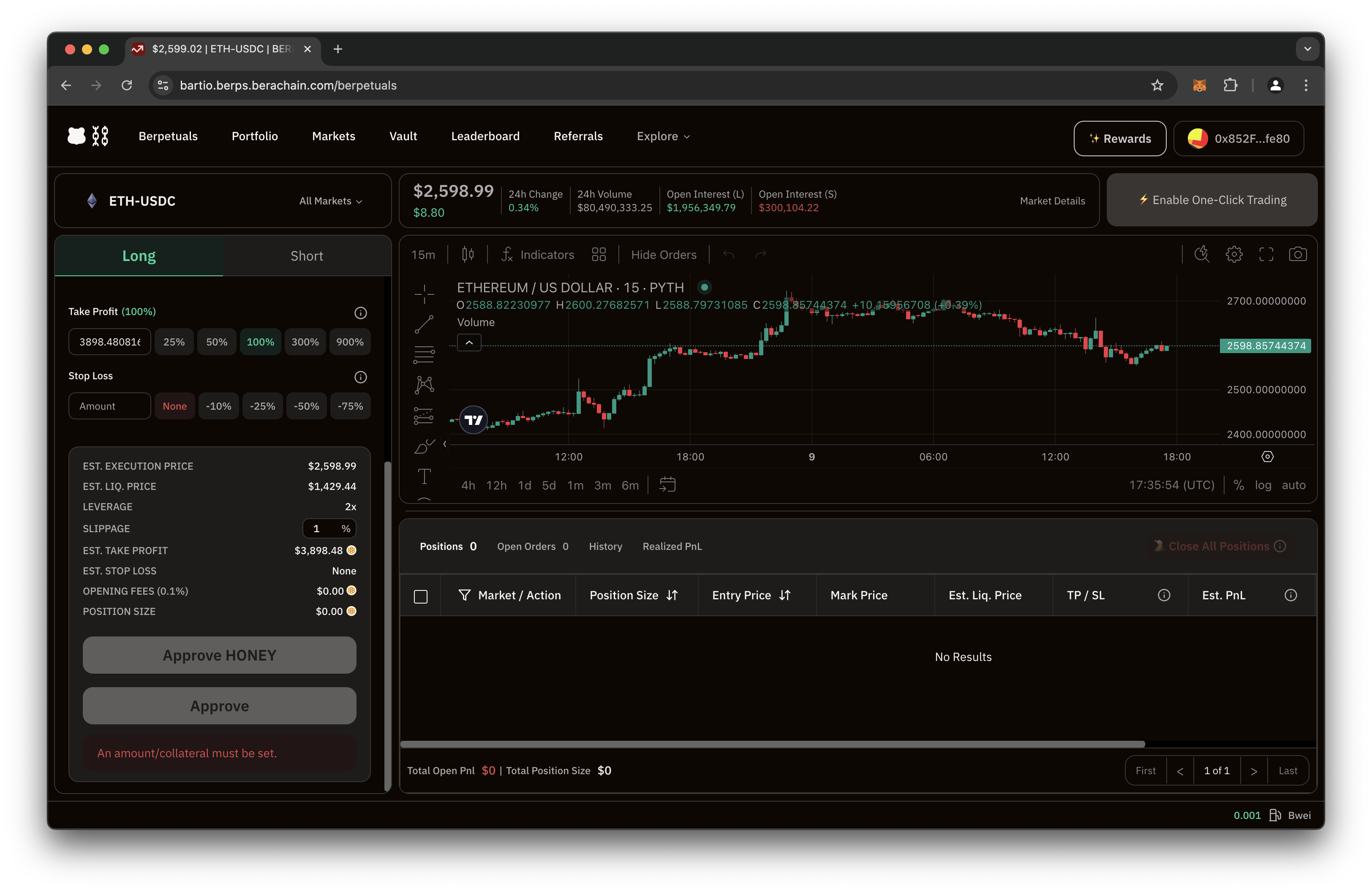

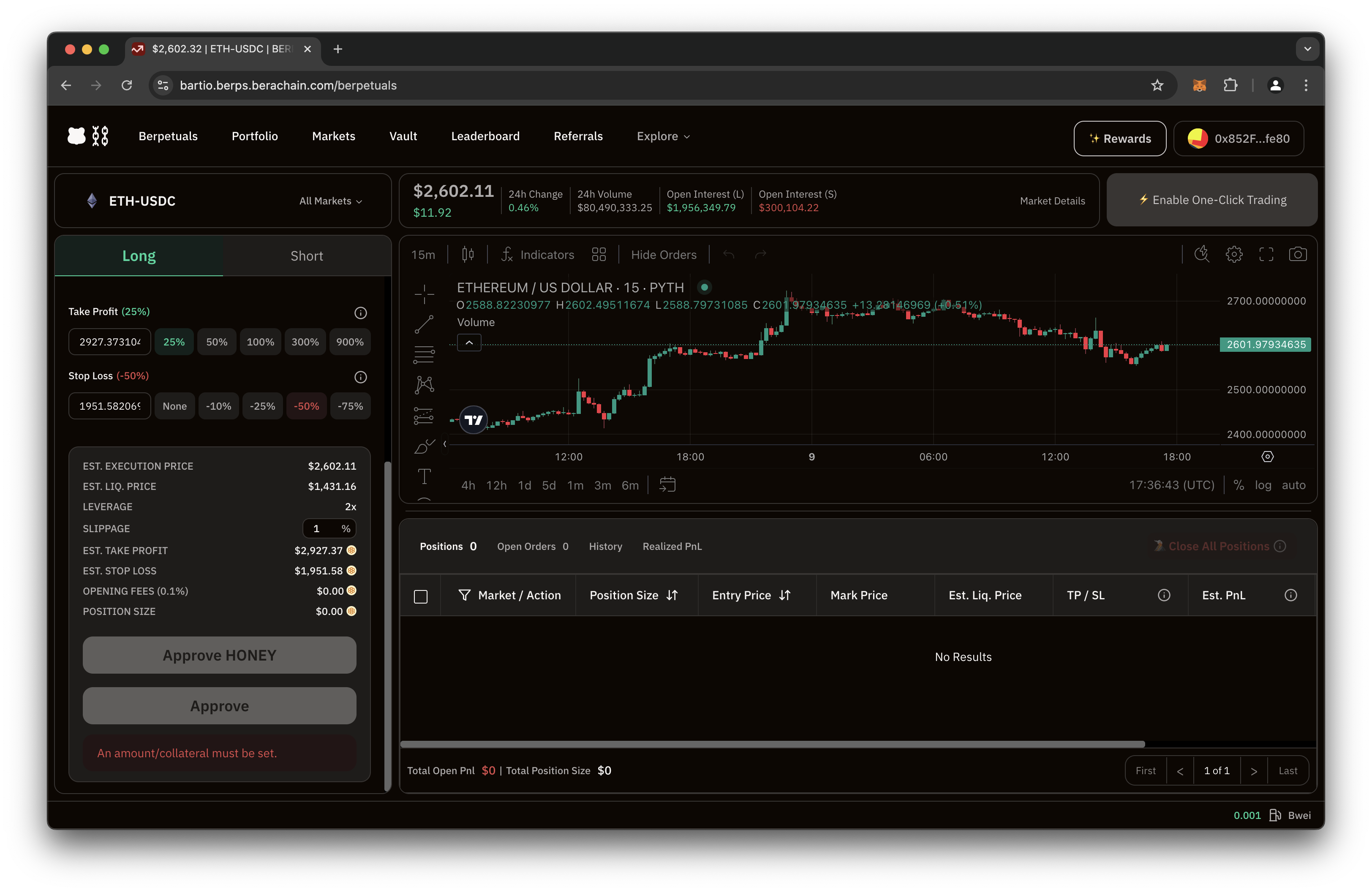

Long

A Long trade is when a trader speculates that the price of token (ex: ETH-USDC) will go up in value in relation to the underlying base token (USDC) over time.

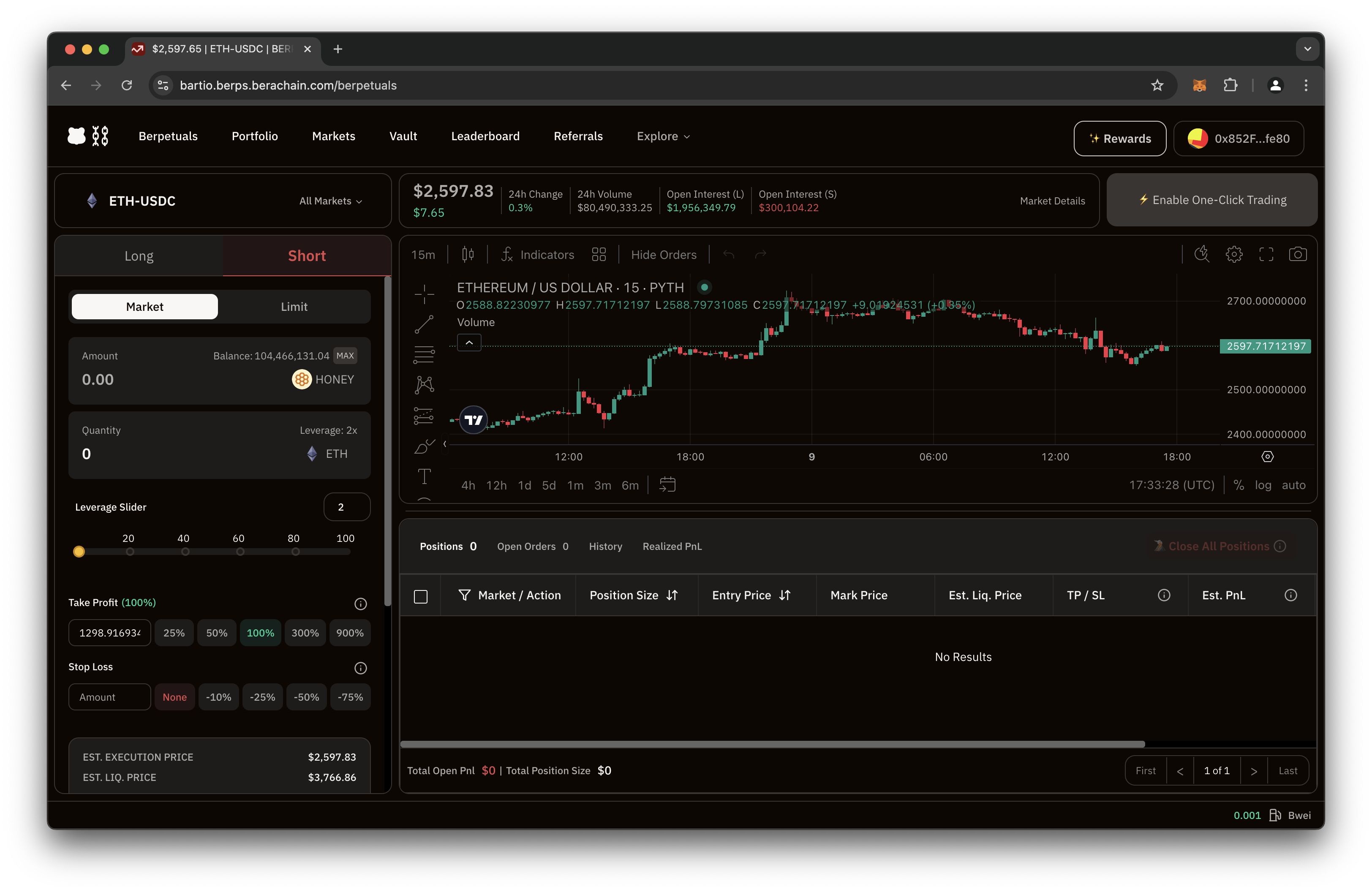

Short

A Short trade is when a trader believes that the price of a token will go down in value over time.

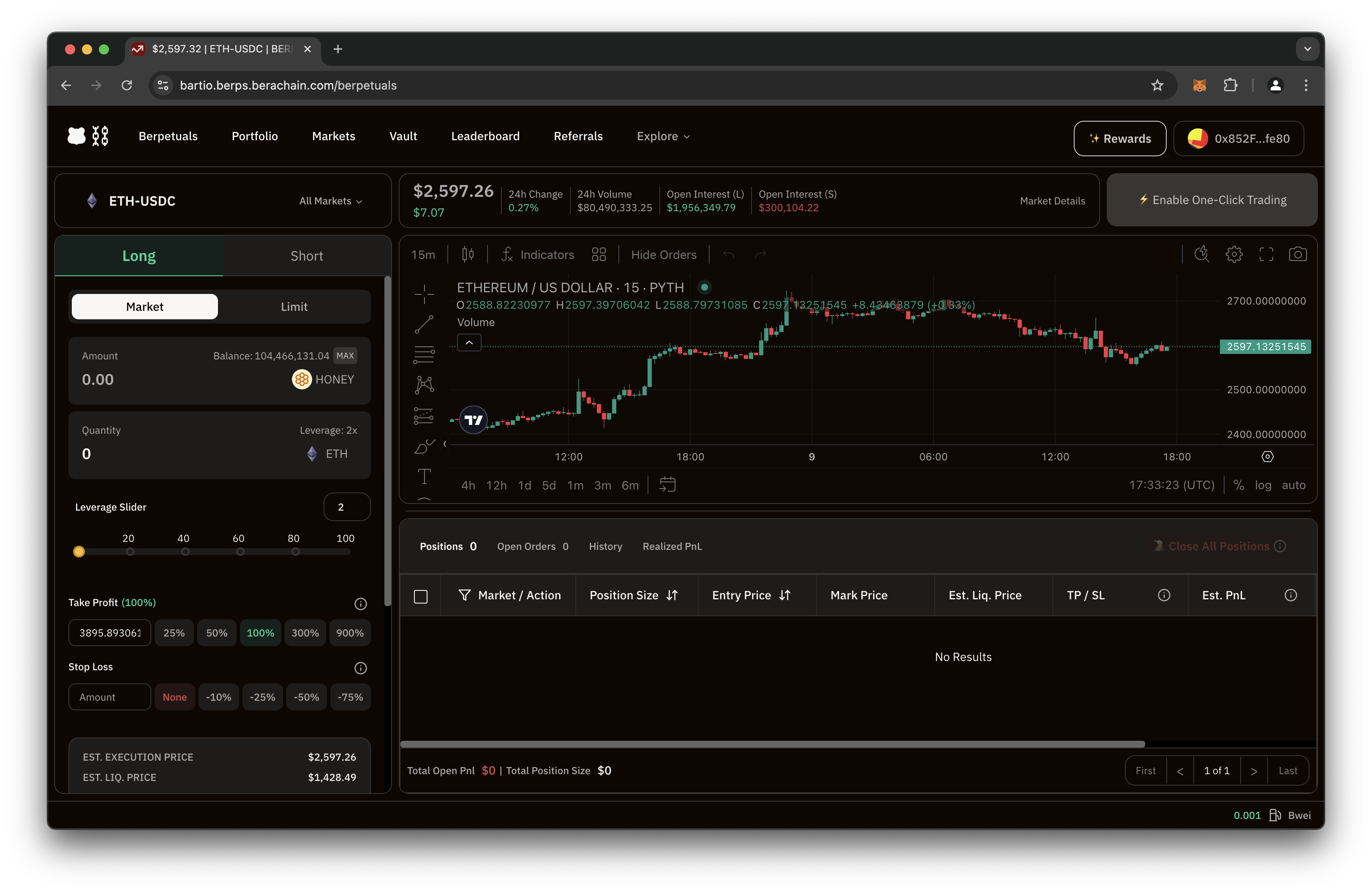

Market Orders

Regardless if a trade is Long or Short, a Market are executed immediately at the current market price.

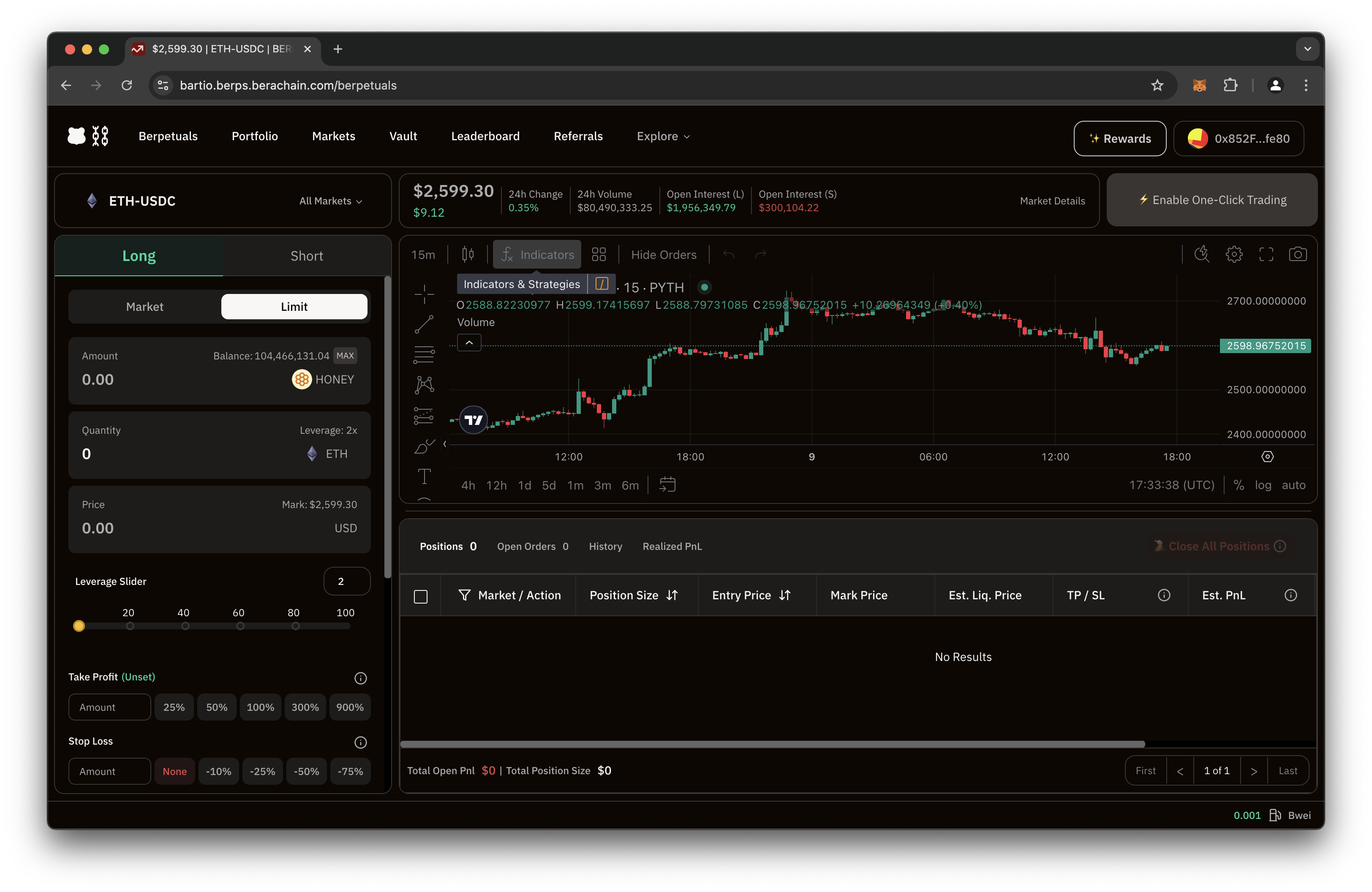

Limit Orders

For Limit trades, a trader will typically specify price parameters which will either buy or sell a trade at the point where that limit has been reached.

The difference between Limit and Market is Limit order may not execute right away and allows users to specify a price at which they want to buy or sell.

Take Profit

An additional parameter that traders can put in place to ensure that their trade sells at a certain profit threshold automatically.

NOTE: Automatically means that the community of liquidation bots will execute the trade for a fee.

Stop Loss

In addition to Take Profit, a Stop Loss can be an additional parameter put in place to prevent the trader from losing their total initial investment and sell off the trade when it reaches a certain threshold for loss automatically.

NOTE: Similar to Limit orders, only reversal limit orders are supported currently. This means that if a trader wants to go long, they must enter at a price lower than the current price. Similarly if a trader wants to go short, they must enter at a price higher than the current price. This also guarantees a more favorable entry price than the current price.