$bHoney Vault 🔒

The first $bHONEY was developed to bolster the Berps trading protocol.

The $bHONEY Vault operates in accordance with ERC-4626, a standard API for tokenized vaults that generate yield and represent shares of a single underlying ERC-20 asset. In this case, $bHONEY shares are indicative of the underlying HONEY asset.

This vault acts as the counterpart for all transactions on the platform:

- Profits (positive PnL) earned by traders are paid out from the vault.

- Losses (negative PnL) incurred by traders are transferred to the vault.

The vault obtains a share of the trading fees, which are evenly distributed among $bHONEY shares, providing an incentive for stakers to remain in the vault.

In scenarios where the overall PnL is negative, the vault begins to form a buffer with these funds, adding an extra layer of security for both the stakers’ deposits and the protocol against unusual PnL fluctuations.

In scenarios where the overall PnL is positive, the stakers may incur a loss on their staked $HONEY.

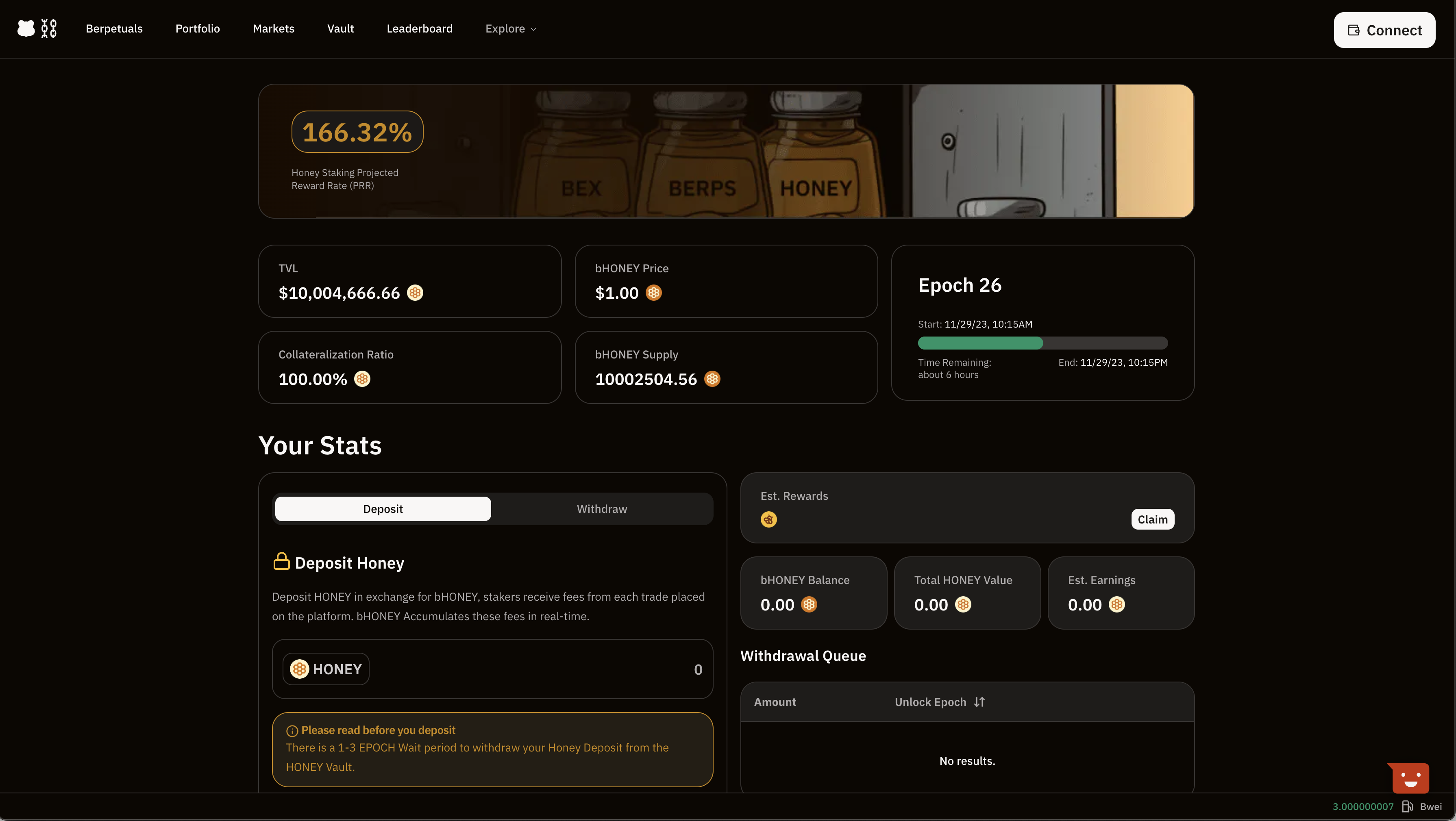

To accurately gauge the real collateralization ratio and reduce risks for the protocol and stakers, the vault employs an epoch system.

Epoch System

The epoch system delivers open PnL information to the vault in a decentralized way, aiding the vault in accurately determining its collateralization ratio. Performing real-time, on-chain computation of open PnL is possible due to Berachain’s on-chain oracle system, Slinky.

This system operates in one distinct phase:

- Withdraw Window - Stakers are allowed to engage in withdrawal-related activities, including both requests and actual withdrawals.

Withdraw Locks

To safeguard the vault and avert the possibility of stakers preempting PnL fluctuations, immediate withdrawal of HONEY is not feasible. It must instead pass through a withdrawal request system.

The timeline for a staker to withdraw their HONEY depends on the vault's collateralization ratio. A staker may be able to withdraw after 1, 2, or 3 epochs following their request, with a higher collateralization ratio allowing for a shorter waiting period.

Should a staker fail to utilize their withdrawal window, they are required to submit a new request.