Overview Of Leveraged Trading 📈

Leveraged trading is a strategy that involves using borrowed money to increase the potential rewards. In this approach, traders use leverage to amplify their buying power, allowing them to make larger trades than their own capital would normally permit. However, while it can magnify rewards, it also increases the potential for significant losses, making it a high-risk trading strategy.

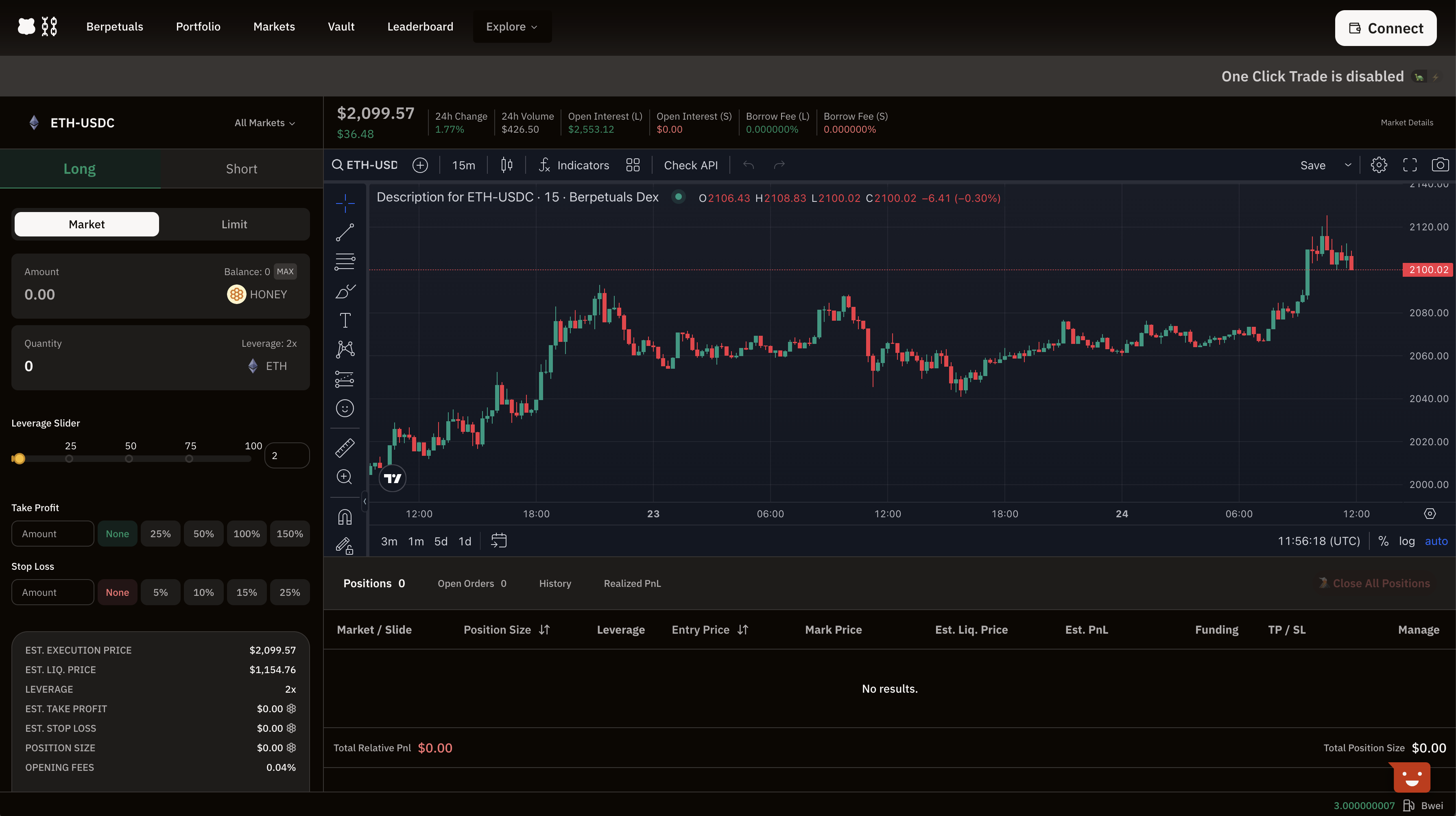

Berachain Berps can be found at https://artio.berps.berachain.com/

Trading Experience

Here are a few benefits of using Berachain Berps:

No Custody Of Your Funds

No deposits or signups required. Ensuring enhanced security and privacy, as traders maintain complete control over their assets without entrusting them to a third party.

Median Spot Prices

Avoiding artificial and sudden price manipulations, providing a more stable and fair trading environment for investors.

Zero Slippage Order Execution

Zero slippage on orders, ensuring that a trade is executed at the exact intended price, without any deviation, providing traders with precise control over their entry and exit points in the market.

Top Listed Crypto Assets

Premier crypto assets with industry leading oracle price feeds.

High Leverages Available

Up to 100x leverage on crypto to maximizer on potential rewards.

Competitive Fees

Some of the lowest costs in perps.

Transparent & Decentralized

All trades are executed 100% on-chain.

Great User Experience

Simple and effect user experience to maximize on getting trades open and closed.

How Does Berps Work?

Trades are opened with $HONEY collateral, regardless of the trading pair. The leverage is synthetic and backed by the $bHONEY Vault, and the $HONEY token. $HONEY is taken from the vault to pay the traders Profit & Loss (PnL) (if positive) or receives $HONEY from trades their PnL was negative.

Powered By Native Oracle

Unlike other derivatives platforms that rely on order books or similar mechanisms, often resulting in a mismatch with the asset's real spot price, Berps employs a bespoke native oracle. This is designed to accurately capture the median price in real-time for each trade processed.

More Than Fair

The native oracle is adept at eliminating extreme price variations that occur on individual exchanges, whether due to manipulative tactics or insufficient liquidity. This assures traders that unexpected liquidations, such as those caused by scam wicks, won't occur.

It's important to emphasize that these trades are entirely under your control. Berps has no authority to initiate, terminate, or modify any details of your active trades, unless you've given explicit permission through the smart contract for actions like setting stop losses or take rewards, or in scenarios where liquidation is necessary.

Be aware that the governance has the capability to temporarily suspend the initiation of new trades, primarily during contract upgrades. However, this action does not affect any existing open positions, and traders maintain full authority over the closure of their trades.

The trading platform is entirely decentralized, ensuring that users maintain full custody of their funds. There's no need for account creation or deposits to begin trading.

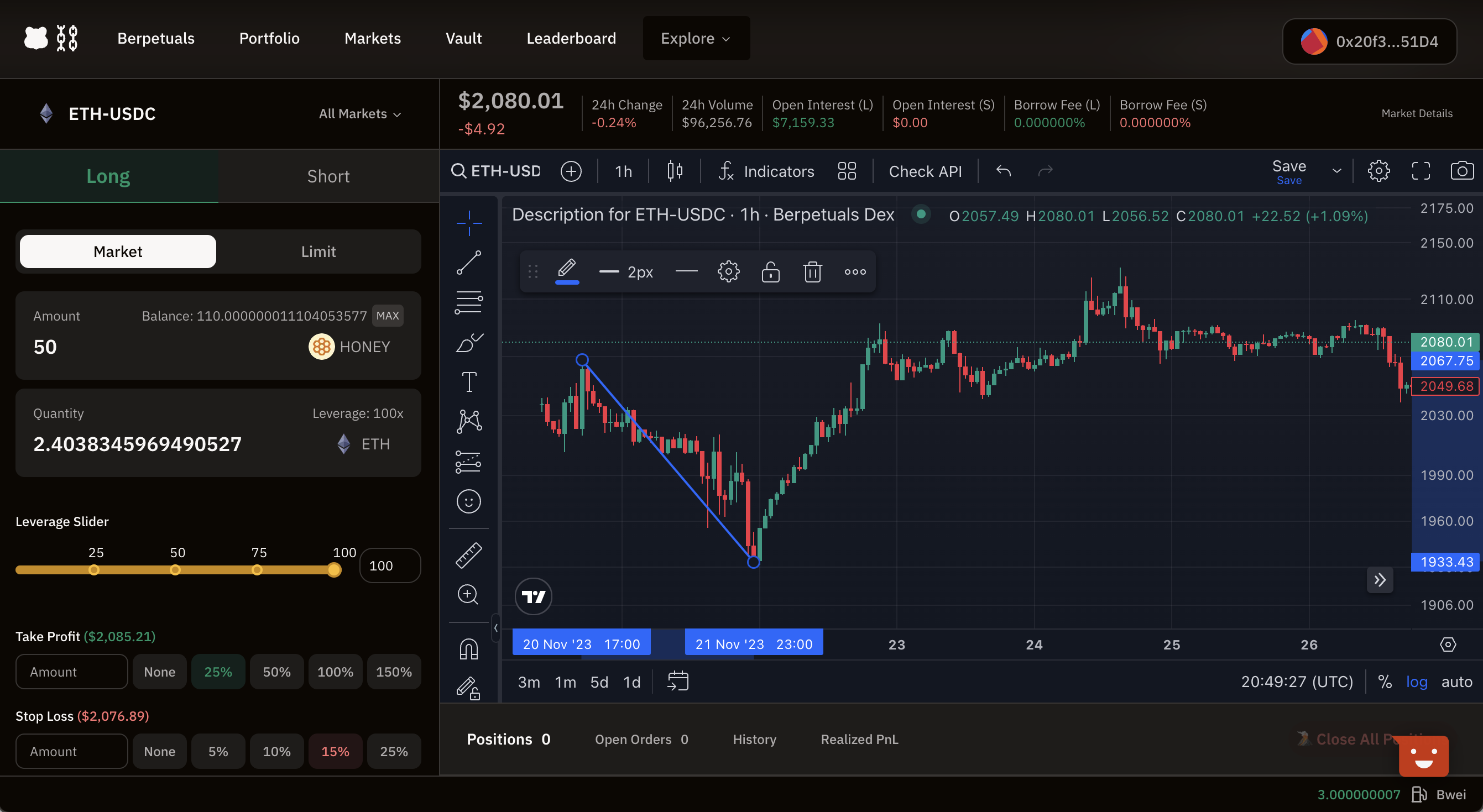

Berps Example

Berps using multiple price sources for every pair (ETH/USDC). In this example the price dipped down on a specific volatile movement.

Let's use the following data as an example to get some insights.

| ETH | USDC (Top) | USDC (Bottom) |

|---|---|---|

| 1 | 2067.75 | 1933.43 |

We can see that price dipped to the USDC (Bottom) on specific volatile movement. This means that a trade could been liquidated on this exchage because it would have reached below its liquidation threshold, and the trade would have not remained open longer to see any rewards.

Taking a look at the difference, with different leverages, and knowing that echange price is 0.09%, these are examples of average trades that happen multiple times a week.

| Amount | Leverage | Position Size | Est. Exec. Price | Est. Liq. Price | % Diff | PnL | Results |

|---|---|---|---|---|---|---|---|

| 100 $HONEY | 100x | 10k $HONEY | 2067.75 | 2049.12 | 0.9% | (13.5)% | Liquidated @ 2049.12 |

In additiona, if you look at the liquidity, selling the position would have takent the price down further, contributing to Scame Wick on the exchange.

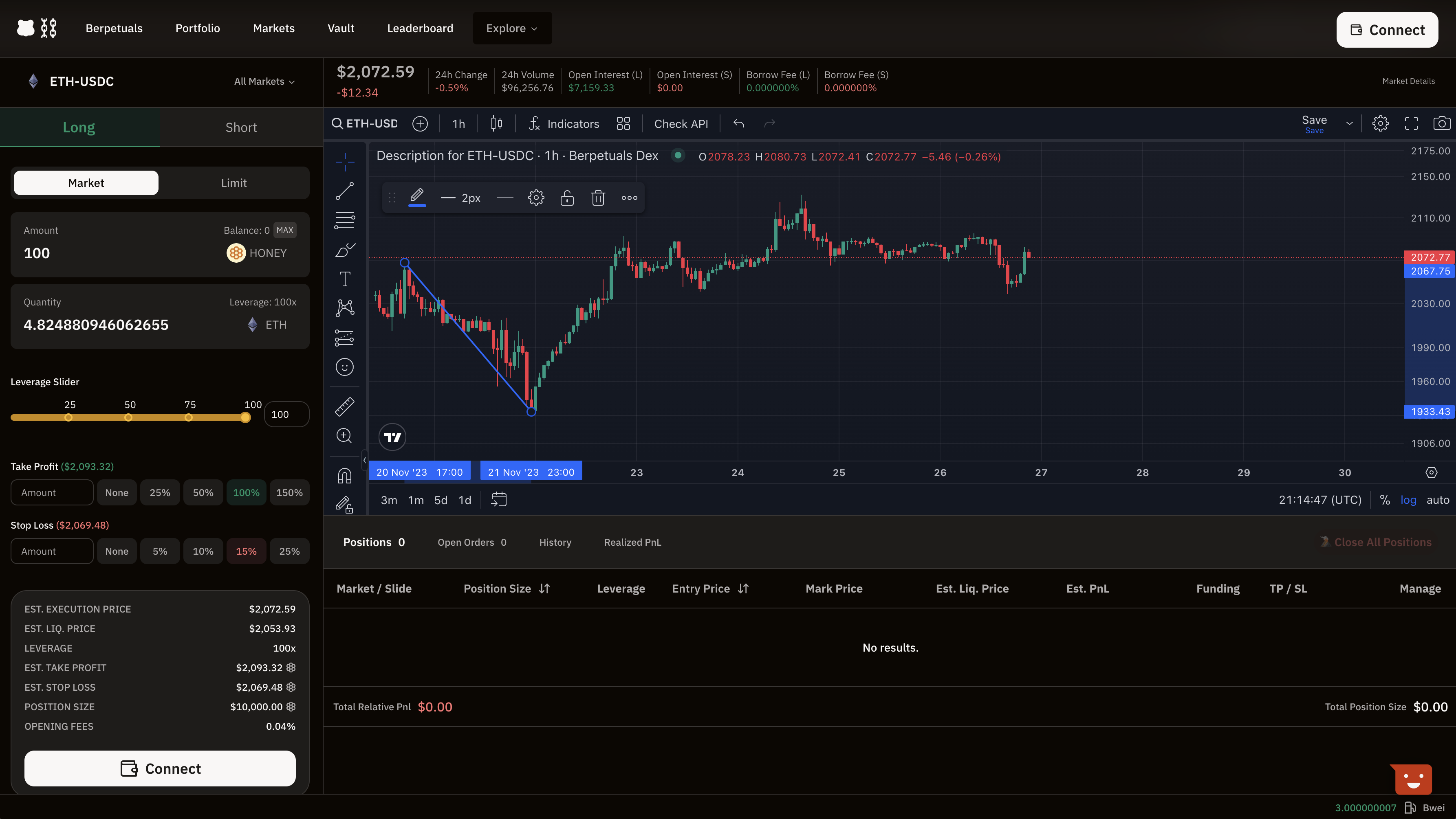

Next-Level Bera-ceptional Trading Experience

Trades on Berachain Berps can be done at https://artio.berps.berachain.com/

With the integration of a unified liquidity pool and $bHONEY vault for processing orders across all listed pairs, this achieved enhanced liquidity efficiency. This approach enables us to provide an extensive range of trading pairs and leverage options

Competitive Trading Fees

The fees are distributed to the $HONEY liquidity providers in a decentralized manner.

You can read more about fees in Fees & Spread.

Liquidity Efficiency

Utilizing a singular $HONEY liquidity layer (trading vault) for all transactions presents a significant edge compared to other platforms, which need to establish and sustain high liquidity for each new pair they list in their order books.

The approach of consolidating a substantial $bHONEY vault, incentivized through trading fees, ensures that every trading pair on the platform is supported by larger position sizes. Consequently, the platform is streamlined to depend solely on $HONEY liquidity for EVERY pair available for trading.

This unique capability stems from the architectural design, which eschews the conventional order book method for matching buy/sell orders. Additionally, the leverage in the trades is "virtual", with profit and loss being calculated within the smart contracts and reconciled against the $bHONEY vault.

Current Limitations

The following are current limitations of Berachain Berps.

Maximum Open Interest (Long/Short) Per Pair & Group Of Correlated Pairs.

This is for better risks management for liquidity providers.

Winning Percentage On Each Trade Capped At 900%

This is for better risks management for liquidity providers.